Gaining real-time insights into how end-customers manage their payments and set up payment plans is essential for streamlining payment processes – ultimately enhancing cash flow and control. At Ropo, we actively monitor end-customer behavior to gather valuable insights that directly contribute to optimizing our services. Our latest survey across Finland, Sweden, and Norway highlights how end-customers prefer to interact when handling their payments and their perceptions of payment arrangements.

We aim to enhance our customer experience, ensuring our end-customer service remains efficient, easy to use, and locally optimized. This commitment enables us to adapt to evolving end-customer needs and provide seamless, reliable service that meets the needs of our clients and their customers.

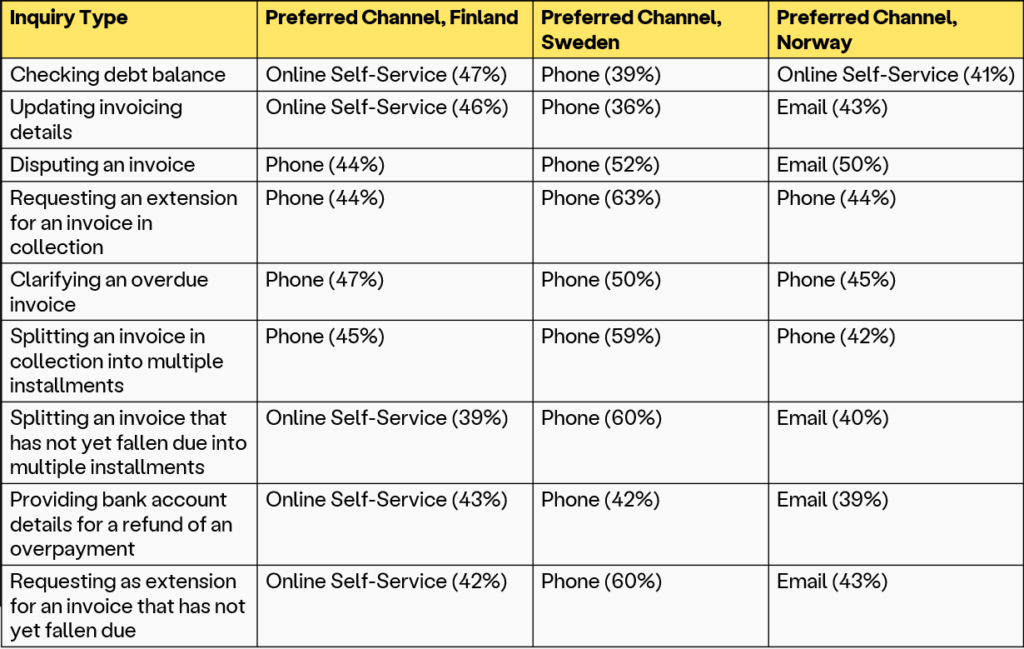

Preferred channels for invoice-related questions

The survey results provide valuable insights into how end-customers in Finland, Sweden and Norway prefer to engage with customer service when managing their outstanding payments.

- Finnish respondents primarily prefer online self-service when managing payment-related tasks, such as checking their debt balance at 47% or updating invoicing details at 46%.

- Norwegian respondents use a mix of all channels, with email and phone being the most preferred options depending on the inquiry type. For example, 50% prefer email when disputing an invoice, while 44% choose phone when requesting an extension for an invoice in collection. Online self-service also plays a role in managing certain tasks.

- Swedish respondents rely more heavily on phone support, particularly 63% for requests related to payment extensions for an invoice in collection.

Across all three countries, respondents indicate a clear preference for personal contact via phone when discussing payment-related matters that require guidance or clarification. While routine tasks are often managed through self-service, phone contact is valued when end-customers seek to explore payment solutions tailored to their situation, receive step-by-step instructions, or gain immediate confirmation from a customer service representative.

This preference is particularly evident in situations where direct interaction provides reassurance and helps navigate inquiries that require discussion, guidance, or confirmation, such as:

- When clarifying an overdue invoice, 47% of Finnish, 45% of Norwegian, and 50% of Swedish respondents would choose to handle the matter by phone.

- When requesting an extension for an invoice in collection, 44% of Finnish, 63% of Swedish, and 44% of Norwegian respondents prefer to handle the request via phone.

- When splitting an invoice in collection into multiple installments, 45% of Finnish, 42% of Norwegian, and 59% of Swedish respondents would rather handle the issue via phone.

Source: Ropo’s End-Customer Survey 2024

By offering multiple contact channels, Ropo ensures that end-customers can choose the most convenient way to manage their payments. This multi-channel approach strengthens service flexibility, supporting a seamless payment experience across all markets.

How do end-customers feel about payment arrangements?

The survey examined how well end-customers’ experiences align with key statements about Ropo’s service, focusing on trust, ease of contact, and support in payment-related customer service. The results highlight how several areas of Ropo’s services were received across different markets:

- Getting in touch feels easy for most – The majority of end-customers feel comfortable reaching out to Ropo, yet some respondents related to the statement “I was nervous about getting in touch.” This concern was least pronounced in Finland (2.4/5), followed by Sweden (2.6/5) and Norway (2.7/5).

- Making payment arrangements is widely accepted – Respondents across all markets recognize that setting up payment plans is a responsible and accepted way to manage financial commitments. This was rated highest in Finland (4.3/5), followed by Norway (3.8/5) and Sweden (3.3/5), indicating that while the practice is generally seen as a good option, attitudes still vary. Importantly, the results confirm that there is nothing to be ashamed of when making payment arrangements.

Delivering a smooth customer experience

Ropo is committed to providing reliable and customer-oriented services across the Nordics, ensuring that end-customers receive professional and efficient support. By continuously refining its services to align with regional preferences and evolving customer expectations, Ropo enables businesses to offer a seamless payment experience.

The study was conducted by Innolink, ensuring a comprehensive and data-driven approach to understanding end-customer behavior.

For further insights from this survey, take a look at our earlier article on end-customer perceptions of service quality and ease of contact.

Read more

Life at Ropo

Employee Spotlight: Oona Koponen, Payment Transaction Specialist & Team Lead

Read more

Services & features

Ropo OneView™ – Real-Time Visibility for Smarter Financial Decisions

Read more

Reports & Research

Smooth Implementation: How Ropo Clients Navigate Major System Changes

Read more

News

Reduced VAT Rate in Finland to Change on January 1, 2026

Read moreReady to streamline your invoicing flow and enhance financial oversight?

Ropo’s experts are here to support you whenever you need assistance optimizing your invoicing processes and cash flow management for improved control, efficiency, and transparency.

Reach out to your local sales team or continue exploring our one-platform approach here:

Login: Finland

Login: Finland