When it comes to invoicing performance, cash flow optimization remains the universal priority driving every strategic decision. Yet the pathways to achieving this goal vary significantly among financial leaders. We asked our CFO network to share the invoicing KPIs they consider most critical – and why – revealing targeted approaches to protecting and accelerating cash flow from multiple angles.

While the core objective of optimizing cash flow remains unchanged, business contexts, operational maturity, and strategic priorities influence how CFOs build their measurement frameworks. Whether through digitalization, collection efficiency, or risk management, every highest-ranked KPI ultimately serves the same fundamental purpose: ensuring money flows smoothly through the business.

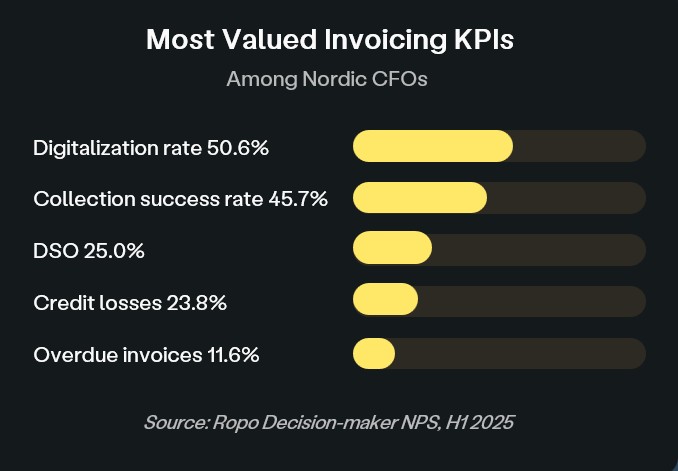

164 financial decision-makers across Finland, Sweden, and Norway shared their top three invoicing KPIs. Digitalization rate emerged as the most prioritized metric (50.6%), followed closely by collection success rate (45.7%) and Days Sales Outstanding (25.0%). These results highlight the Nordic focus on both operational efficiency and cash flow optimization.

Most valued invoicing KPIs. Source: Ropo Decision-maker NPS, H1 2025

The strategic thinking behind measurement priorities

When CFOs explain their KPI choices, cash flow optimization emerges as the connecting thread across all measurement strategies. However, their approaches reflect different operational realities and market pressures.

Many CFOs underlined the importance of forecasting accuracy and cost-efficiency: “Increasing the level of digitalization is a key objective to achieve cost savings and reduce delays in payments. The percentage of invoices paid during the reminder and collection phase is an important metric for tracking overall trends in customer payment behavior”, explains one CFO. The focus on digitalization often stems from proven experience with accelerated cash flow – digital invoices consistently get paid faster than paper alternatives.

Others emphasize the reputation and relationship management aspects of invoicing performance: “We see a clear link between how our invoicing works and how our company is perceived by customers. It’s directly decisive for our reputation.” These leaders recognize that smooth invoicing processes protect both cash flow and customer relationships simultaneously.

Risk management considerations also drive KPI selection, particularly in challenging economic environments: “We operate in an industry with very small margins, so credit loss rates must be monitored closely,” notes another respondent, highlighting how market conditions influence measurement priorities.

DSO remains the universal benchmark

Despite varying operational approaches, Days Sales Outstanding (DSO) emerges as a critical metric across all markets, serving as the ultimate measure of cash conversion efficiency. CFOs value DSO because it captures the cumulative effect of all invoicing processes – from initial delivery through final payment.

“DSO is the best metric for improving working capital management,” summarizes one respondent, capturing why this KPI remains a cornerstone of financial performance measurement. Whether used for liquidity planning or cash flow optimization, DSO provides the comprehensive view that CFOs need to understand their overall performance.

Digital transformation accelerates cash flow

The emphasis on digitalization metrics reflects growing recognition of digital invoicing as a strategic cash flow advantage. Organizations focusing on digital transformation report measurable improvements in payment speed and customer experience.

“We want to minimize both our own and our customers’ costs related to invoice payments, which works best by paying electronic invoices on time,” explains one CFO. “We consider electronic invoicing as more reliable than paper invoices, which sometimes go to the wrong address or fail to reach their destination.”

The cash flow impact is significant: digital invoices consistently get paid faster, reducing DSO and improving working capital efficiency. This speed advantage, combined with cost savings and improved traceability, makes digitalization rate a key predictor of overall financial performance.

Collection performance – maximizing recovery rates

Our Nordic CFO network consistently prioritizes collection success rates because they directly impact cash flow recovery. Even small improvements in collection success translate to meaningful financial impact across large invoice volumes, particularly when approximately 2% of invoices typically enter the collection process.

CFOs emphasize the importance of proactive and systematic approaches to collection management: “It’s important to address overdue invoices as early as possible, and digitalization helps here too when invoices reach recipients more reliably and on time,” explains one respondent. This perspective highlights how early intervention and process optimization can prevent issues from escalating while maintaining positive customer relationships.

Others view collection success as essential risk mitigation: maintaining healthy cash flow becomes critical for business continuity, particularly in challenging economic environments where payment delays are increasing across industries.

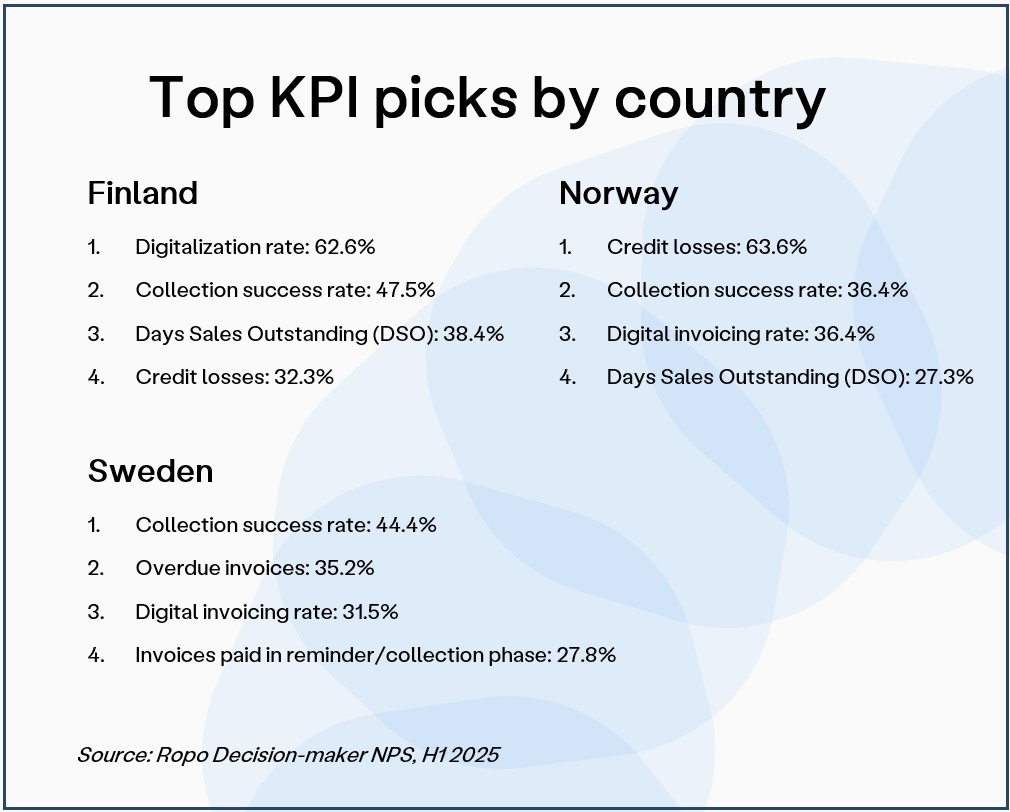

Top KPI picks by country. Source: Ropo Decision-maker NPS, H1 2025

Note: Respondents selected their top three invoicing KPIs.

Key insights for financial performance

Rather than relying on single metrics, the most effective leaders maintain visibility across multiple performance indicators while focusing on those most relevant to their specific context.

Three key patterns emerge for CFOs evaluating their measurement strategies:

- Universal cash flow focus: DSO and collection success remain critical regardless of market context, serving as fundamental tools for managing working capital and revenue recovery.

- Digital maturity drives results: Organizations with higher digitalization rates report direct cash flow benefits through faster payments and improved customer experience, creating competitive advantages for early adopters.

- Context-driven priorities: The most relevant KPIs align with industry conditions, operational maturity, and strategic objectives – but comprehensive real-time visibility enables agile responses to changing market conditions.

“The most successful CFOs don’t settle for just one metric but build comprehensive monitoring systems that provide holistic visibility into their cash flow,” says Ropo’s CFO Toni Rönkkö.

“Cash flow management is also becoming increasingly dynamic. CFOs need real-time data and the flexibility to respond quickly to changing conditions,” he continues.

“Our one-platform approach enables exactly this – finance teams can easily access all relevant KPIs and choose to focus on the metrics that matter most to their specific business context, whether that’s digitalization rates, collection performance, or cash flow timing.”

This article is part of Ropo’s CFO Insights and Trends series,

featuring expert perspectives, key trends, inspiring financial leaders, and more.

Subscribe to CFO Insights and Trends

Stay ahead in financial leadership

Subscribe for CFO insights, expert perspectives, trends, and inspiring financial leader profiles. CFO Insights and Trends is delivered straight to your inbox around six times a year, and you can easily unsubscribe at any time.

Read more

Life at Ropo

Meet Moona: From Fashion Blogging to Coding – Curiosity Opened the Door

Read more

Insights & Trends

3 Days Faster Cash Conversion with Process Improvements

Read more

Insights & Trends

Inside Ropo Norway: Turning Invoicing Into a Competitive Advantage

Read more

Services & features

Login: Finland

Login: Finland