New survey data reveals evolving preferences for managing payment matters – and shows that digital adoption is accelerating across the Nordics.

As digital services continue to evolve, understanding how customers want to manage their payment matters becomes increasingly important. Ropo’s 2025 End Customer Survey, conducted across Finland, Sweden, and Norway with 1,237 respondents, reveals clear patterns in how customers prefer to handle different payment scenarios.

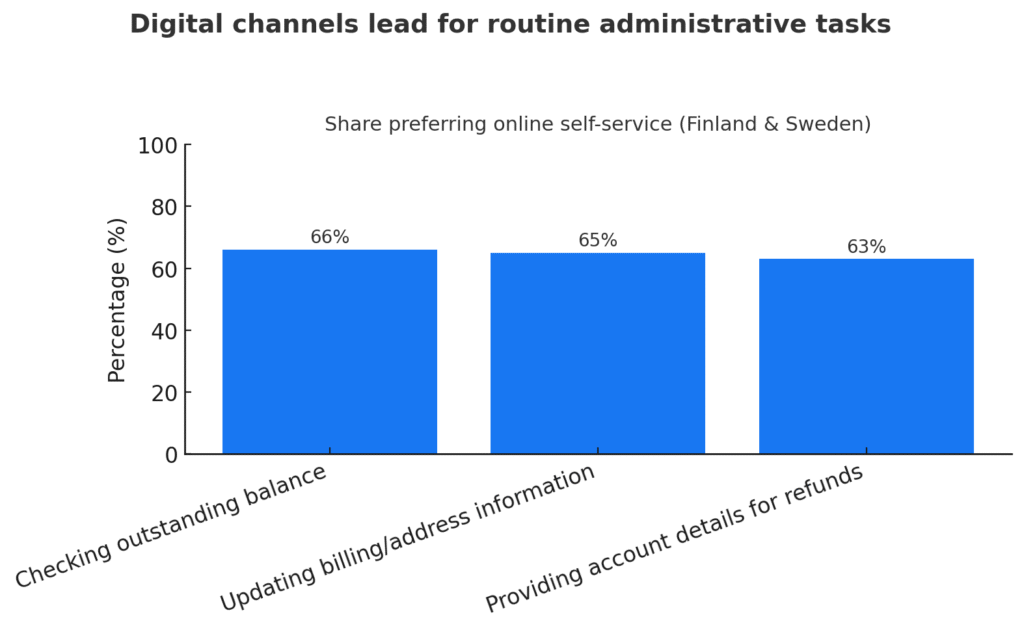

Digital channels lead for routine administrative tasks

Online self-service has become the preferred channel for routine administrative tasks across Finland and Sweden:

- Checking outstanding balance: 66% prefer online

- Updating billing/address information: 65% prefer online

- Providing account details for refunds: 63% prefer online

These results reflect customers’ growing comfort with digital tools and their appreciation for 24/7 accessibility. The ability to manage payment matters independently, at any time, has become an expected standard in modern service delivery.

In Finland and Sweden, customers prefer digital self-service for routine administrative tasks such as checking balances, updating information, and providing account details.

Preferences vary for complex payment matters

For more complex payment matters, customer preferences show greater variation. When managing overdue invoices or arranging payment plans, preferences depend on factors including urgency, complexity, and individual comfort with digital tools.

MyRopo supports even complex payment scenarios through intuitive digital channels. At the same time, we maintain accessible customer support – including phone and other digital communication options – to ensure customers can always get the guidance they need.

The key insight from across all markets is clear: customers value having options. Whether managing a simple balance check or navigating a complex payment arrangement, the ability to choose the most suitable channel based on individual needs and circumstances creates confidence and satisfaction.

Designing services for the future

These insights guide our ongoing service development strategy:

Continuous digital enhancement: Customer feedback directly informs how we enhance MyRopo’s capabilities. The platform handles the full spectrum of payment matters, from simple inquiries to complex arrangements, with continuous improvements based on real user needs.

Accessible support when needed: While digital channels continue to grow, we recognize that personal guidance remains valuable. Our multi-channel approach ensures customers can access support through their preferred method – digital or personal – based on their specific situation.

Trust through transparency: Clear communication, intuitive design, and reliable service build confidence in digital channels over time.

Looking ahead

The survey data shows that digital adoption for payment services continues to grow year over year, particularly in our established markets. As customer expectations evolve, so do our services – ensuring that managing payment matters remains straightforward, accessible, and customer-centric across all channels.

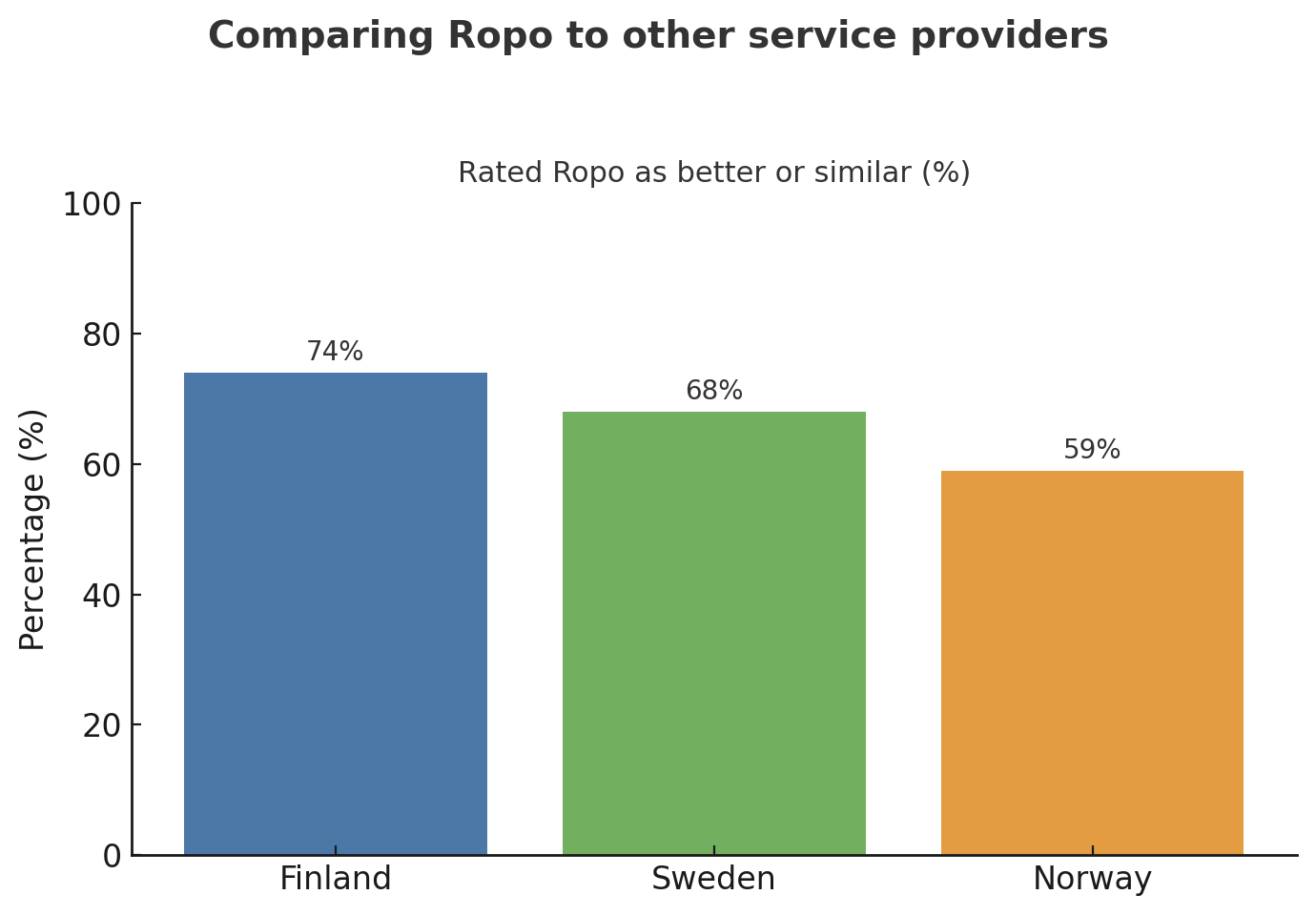

When comparing Ropo’s service to other companies, 74% of Finnish customers, 68% of Swedish customers, and 59% of Norwegian customers rated our service as better or similar to other providers. This suggests that our multi-channel approach – combining efficient digital tools with accessible personal support – resonates with customers across the Nordics.

Survey results highlight that a clear majority of customers across Finland, Sweden and Norway consider Ropo’s service equal to or better than other companies.

About the survey

Ropo systematically studies end-customer experience and customer service channel preferences through post-contact feedback surveys and the broader annual end-customer experience survey. This approach ensures that both immediate feedback and long-term trends inform the continuous development of our services.

Explore our service

Unify your invoicing process to improve control, visibility, and customer experience. Ropo helps you streamline your invoice and payment flows end-to-end for efficiency and optimized cash flow.

Read more

Client stories

How Nordic Energy Companies Optimize Invoicing and Achieve Faster Cash Flow – Five Proven Strategies

Read more

News

How Nordic Customers Want to Handle Payment Matters in 2025: Digital Self-Service Continues to Grow

Read more

Ajankohtaista

Ropo’s Annual End Customer Survey 2025: Strong Customer Satisfaction Across the Nordics

Read more

Insights & Trends

Login: Finland

Login: Finland