CEO Blog

Imagine a driver navigating a car blindfolded. Whether it’s a sleek sedan, a family wagon, whether it’s red car, white, or blue, speeding down a highway or rolling along a garden path – would you happily take the passenger seat? Or would you hope never to meet that car on the road?

Even with the world’s best driver at the wheel, you’d likely prefer to travel in a car with clear visibility. You’d want the driver to see ahead, whether it is the most talented professional driver or someone you truly trust, behind the wheel.

Now, imagine you are making a significant decision – buying a house, acquiring a company, or even a smaller choice like what to order at a restaurant. Would you buy a house without thoroughly checking the reports and paperwork? Invest in a company without a proper background check and financial review? Order something familiar without glancing at the menu?

Or would you rather have full visibility into the matter and base your decision on facts and data? Utilize professional analyses tailored to your needs, complemented by benchmark data for easy comparison. Would you prefer to sift through general data, hoping to find the necessary details, or simply go with your gut?

If you are like most top business leaders, especially those responsible for financial outcomes, you always back your decisions with solid data. And if you are a typical CFO, you meticulously mine data to improve visibility, guiding the company with precision.

At Ropo, we focus on this critical need: providing essential information and streamlining processes to facilitate data collection and efficient workflows. When making decisions, driving growth, and driving success, leaders need reliable data.

For established companies with real business, customers and sales, cash flow is one of the most critical data points. Understanding where it originates leads us back to invoices – by tracking invoices and payments, we can follow the money flow.

Ropo’s strategy is straightforward: we modernize legacy setups to streamline all the internal and external processes related to invoicing.

Our one platform approach transforms invoicing flow and eliminates unnecessary complexities to beat financial friction.

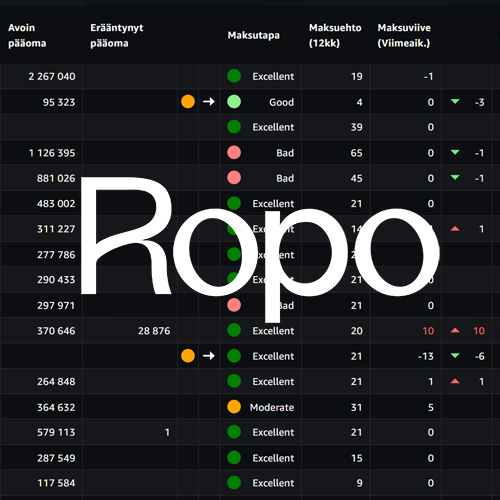

By giving our clients control, full visibility, and seamless data flows, we ensure they are not the ones driving blindfolded. Instead, they are equipped with precise data, consulting dashboards for insights and relevant KPIs to improve cash flow and enhance customer experience.

Consider a company that elevates its cash flow forecasting and KPI monitoring, enabling quick reactions, optimized business operations, and the effective use of customer data from sales ledgers, invoicing, and payments. Now, compare it to a counterpart lacking this knowledge and data. Which one would you invest in? Which one would you prefer to work for?

Ropo has undergone a significant brand update, marked by the largest platform launch in our history. We’ve introduced Ropo OneView, a new business intelligence tool, along with an updated commercial offering.

Discover more about our one platform approach and our mission to beat financial friction. We are here to help you to master the art of invoicing.

Ilkka Sammelvuo

CEO of Ropo

LinkedIn

Makes your business flow

Learn how we can help you master the art

of invoicing and beat financial friction

Read more

Services & features

Ropo One™ Reporting – Financial Reports for Daily Operations

Read more

Client stories

Helsinki Region Environmental Services (HSY) Expands Partnership with Ropo

Read more

Services & features

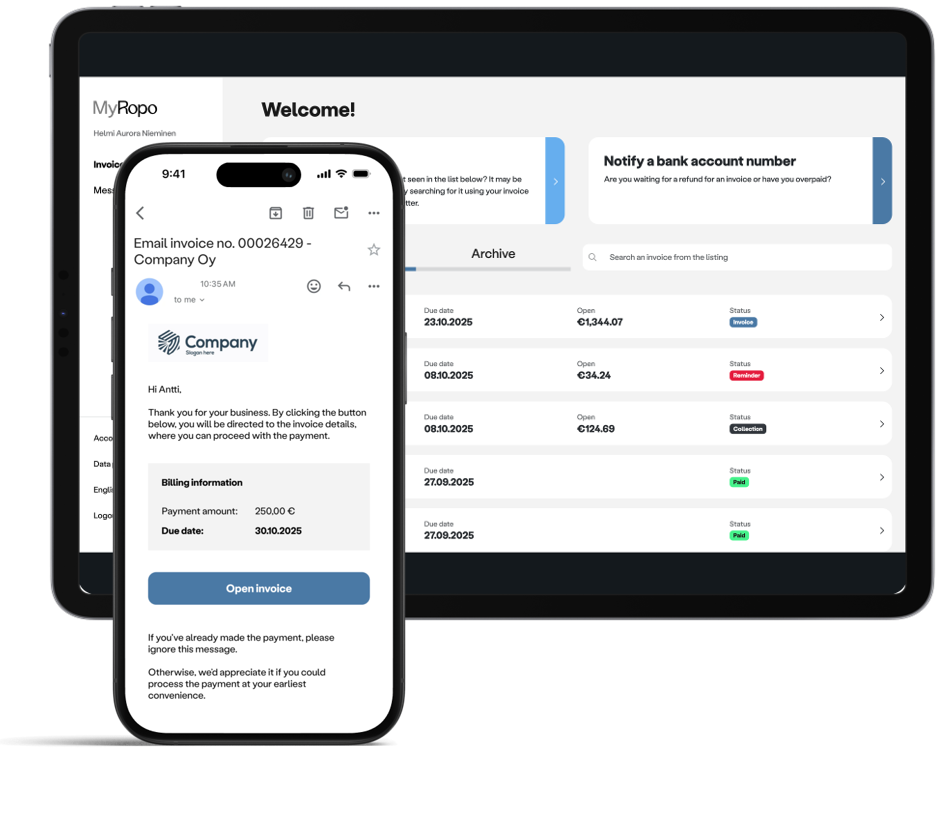

MyRopo Invoice – For A Frictionless Payment Experience

Read more

Services & features

Login: Finland

Login: Finland