AI is no longer just a tool for automation – it is a strategic asset in financial leadership. From refining investment strategies to improving internal processes, AI is reshaping the role of finance executives. But how can they harness its potential in practice?

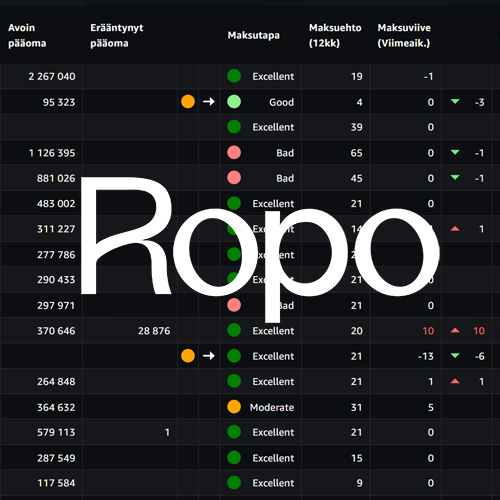

As AI becomes more central to financial management, CFOs are increasingly involved in building smarter workflows and guiding the implementation of intelligent systems. A platform like Ropo One™, which provides full visibility into financial processes from invoicing to payments, offers a strong foundation for this transformation.

To better understand the broader role AI could play in enhancing financial decision-making and supporting more effective operations, we asked two leading experts in the field – Markus Mäkelä, Head of AI at the Lappeenranta-Lahti University of Technology, and Jukka Sihvonen, Professor at Aalto University – what they would highlight when it comes to financial leadership and AI.

Predictive analysis and scenario planning for CFOs

Forecasting in financial leadership is evolving. Rather than relying solely on past financial performance, AI enables finance teams to surface emerging patterns and subtle shifts that may indicate upcoming changes in demand or market conditions. This gives CFOs a more dynamic foundation for planning, allowing them to stress-test scenarios with better-informed assumptions.

This is particularly useful when assessing investments and growth strategies. Mäkelä sees that one of AI’s many valuable uses is as a way to compare expansion options: should the company enter new geographical markets, develop new product lines, or strengthen its current customer base?

AI is a valuable tool to improve information processing for decision case comparisons and even for finding information better. Given how AI supports strategy formulation in evaluating growth options and in numerous other strategic decisions, it can improve the quality of financial analysis. It does this by alleviating the age-old problem of analysis: uncertainty over the quality of assumptions and input data, as in the GIGO saying: garbage-in, garbage-out.

A new era of risk management

AI can enhance financial leaders’ ability to evaluate complex or non-recurring risks by identifying relevant insights from large datasets, including external, public information. While AI can support risk assessment, recurring risks are often well understood without AI, and final decisions still require human judgment.

Mäkelä highlights AI’s value in assessing atypical risk scenarios, such as new investment opportunities.

“AI can provide additional insights into business decisions with high risk, including from weak market signals that traditional analysis might overlook,” he notes.

Still, he stresses that AI cannot replace human judgment. “Executives must critically assess AI-generated insights. Combining human expertise with AI brings the keys to success.”

Building smarter workflows with AI agents

While AI can support better forecasting and risk evaluation, Jukka Sihvonen, Professor at Aalto University, emphasizes that its greatest impact may lie in the everyday processes of finance teams. His research shows that generative AI is particularly effective in tasks where human performance tends to vary. When used properly, AI can lift the quality and speed of these tasks to a consistent, higher level – benefiting the entire organization.

This insight is now guiding the development of AI agents: small, specialized tools trained to handle routine financial tasks such as forecasting, internal reporting, or budget planning. Sihvonen points out that finance teams are learning to combine these agents into connected processes – chaining their functions to accelerate reporting cycles and support decision-making more efficiently.

Instead of replacing experts, AI changes the nature of their work. As agents take over parts of financial workflows, human professionals step into new roles: monitoring, refining, and improving these digital co-workers. “You could think of the agents as new team members,” Sihvonen says. “The controllers remain in charge – they become team leads who guide the development and performance of their AI assistants.”

Rethinking financial reporting in the age of AI

Sihvonen also highlights a more strategic shift: the way financial reporting is produced – and for whom. As more external stakeholders rely on AI systems to interpret financial and sustainability disclosures, finance leaders must begin considering not just the content of their reports, but also how AI will read and extract meaning from them.

“This is what we call AI optimization,” Sihvonen explains. “It’s no longer just about writing for a human reader. Many stakeholders are using AI to interpret long and complex documents, so companies should test how AI interprets their messages – and adapt accordingly.”

This shift will likely become more relevant as regulations and stakeholder expectations around ESG reporting continue to grow. Finance teams should prepare not only for more reporting, but for a new kind of audience: intelligent systems that summarize and evaluate performance on behalf of investors, regulators, or analysts.

From digital assistants to strategic resilience

While many AI benefits are operational, the bigger picture is also changing. As financial functions become increasingly digitized and automated, the systems and agents supporting them evolve into valuable digital assets. “These tools are not just software – they become critical parts of the company’s infrastructure,” Sihvonen notes.

This raises questions about governance and security. If digital assistants manage key reporting or planning processes, what happens if they fail or are compromised? According to Sihvonen, finance leaders must ensure their teams understand how these systems work – and how to safeguard them.

Making AI work in the real world

Both Sihvonen and Mäkelä agree that AI offers powerful tools for improving financial processes – but it requires thoughtful implementation. Success depends on strategic implementation, careful risk management, and the ability to connect AI solutions to real business needs.

Mäkelä emphasizes aligning AI with core strategy, investing in data readiness, and building processes and capabilities within finance teams. Sihvonen encourages leaders to understand the practical strengths and limitations of AI, and to think creatively about how intelligent systems can support, not replace, human expertise.

For finance leaders, the challenge is no longer whether to use AI – but how to do so intelligently. Those who combine innovation with clear direction will be best positioned to lead their organizations forward in an evolving digital economy. Solutions like Ropo One™ can help create the transparency and control needed to build secure, efficient, and insight-driven financial operations. As AI continues to evolve, financial leaders are not just adopters, but active architects of smarter, more resilient financial organizations.

This article is part of Ropo’s CFO Insights and Trends series, featuring expert perspectives, key trends, inspiring financial leaders, and more.

Subscribe to CFO Insights and Trends

Stay ahead in financial leadership

Subscribe for CFO insights, expert perspectives, trends, and inspiring financial leader profiles. CFO Insights and Trends is delivered straight to your inbox around six times a year, and you can easily unsubscribe at any time.

Read more

Services & features

Ropo One™ Reporting – Financial Reports for Daily Operations

Read more

Client stories

Helsinki Region Environmental Services (HSY) Expands Partnership with Ropo

Read more

Services & features

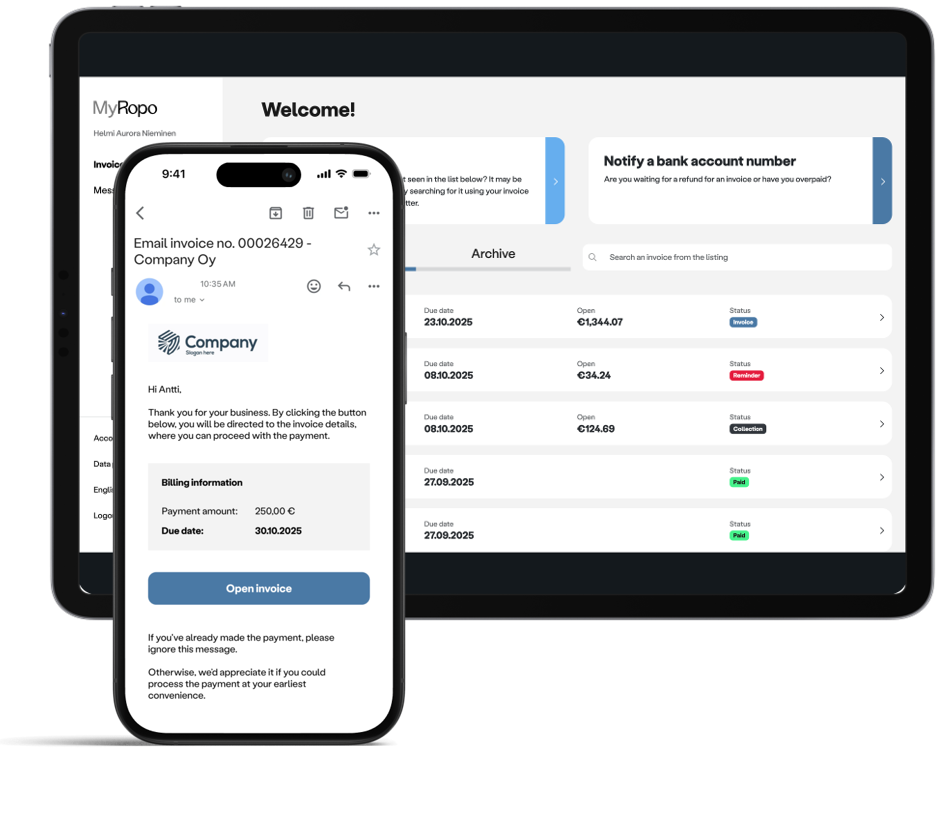

MyRopo Invoice – For A Frictionless Payment Experience

Read more

Services & features

Login: Finland

Login: Finland