In our Inside the CFO Office series, we meet inspiring financial leaders who share their professional journeys, leadership insights, and perspectives on the evolving world of finance. This time, we spoke with Pirjo Kivari, CFO of Oulun Energia, a valued Ropo client since 2021. Her career path, leadership philosophy, and views on how the role of finance leaders has changed and continues to evolve offer valuable insights for today’s financial leaders.

A determined path from day one

Pirjo’s journey into finance began with the kind of clarity most professionals spend years searching for. Already during high school, she knew exactly where she was headed – though the memory of that decisive moment has faded with time.

“My parents clearly remember how determined I was about studying economics and business, even if I personally don’t recall being that decisive at the time,” Pirjo reflects with a laugh.

At the University of Oulu, she pursued a degree in Economics and Business Administration, specializing in Accounting with a minor in Business Law. A particularly inspiring auditing lecturer solidified her passion for the field, setting her on a path where analytical precision and strategic thinking would become her strongest assets.

After graduating in 1997, Pirjo began her career at Nokia as a Business Controller, initially joining through her thesis project. But auditing continued to capture her interest, eventually drawing her to KPMG in Helsinki in 2002. Later, returning to Oulu, she further developed her expertise in financial due diligence and corporate transactions at Ernst & Young (now EY).

Her CFO journey has spanned multiple industries – from NetHawk Oyj and Oulu University to Kaleva Media and, most recently, Oulun Energia. The common thread? An insatiable curiosity that has driven every career move.

“I’ve always been curious to explore new industries and challenges, so whenever a new opportunity came along, I embraced it.”

Leadership through empowerment

Pirjo’s approach to leadership reflects the same openness that has shaped her career. She describes her style as collaborative and supportive, built on a foundation of trust and clear expectations.

“I give my team space but also set clear objectives. Regular meetings ensure everyone understands our direction and knows they’re supported if challenges arise.”

She emphasizes that leadership isn’t about micromanaging, but rather about empowering people to take ownership of their responsibilities while maintaining strong team collaboration.

“It’s important for team members to own their roles but never feel alone in their work. My role is to guide and support them, ensuring we reach our goals together.”

But empowerment without standards leads nowhere. Pirjo underscores that while autonomy is crucial, accuracy remains non-negotiable.

“Numbers must be correct, well-prepared, and carefully documented, so we can confidently make informed decisions.”

From historical reporting to strategic foresight: Data-driven approach

Pirjo emphasizes the critical role of data-driven management in modern financial leadership, highlighting how transparency and real-time analytics shape proactive decision-making.

“Purely historical reporting is outdated. Today’s financial leaders must use enriched data analytics and scenario modeling to make forward-looking, proactive decisions.”

At Oulun Energia, real-time analytics and dashboard tools support business operations beyond traditional financial reporting. Pirjo regularly monitors key financial metrics such as EBITDA, net debt, and return on invested capital – reviewing them monthly with the management team and board of directors. She stresses the importance of clearly defining strategic targets and continuously evaluating these figures against company objectives.

“EBITDA and net debt levels are especially critical, as they’re often part of financial covenants and directly reflect financial health and performance.”

Pirjo also highlights cash flow management as a cornerstone of financial stability. The best financial advice she ever received underscores this principle:

“Always focus on healthy cash flow. If cash flow is healthy, the company usually is too.”

For Pirjo, effective financial management today involves seamlessly integrating data insights into daily operations and strategic planning – constantly looking ahead rather than simply reviewing past results.

The changing role of finance leaders

The CFO role has grown increasingly complex, and Pirjo acknowledges this evolution candidly. Growing geopolitical uncertainty, rapidly changing regulations, and global volatility require thorough scenario modeling.

“Geopolitical factors and complex regulations, especially within the EU, significantly impact financial management. Scenario planning has become more challenging but also more essential.”

Rather than viewing this complexity as a burden, Pirjo sees technology – particularly artificial intelligence – as a powerful ally in managing uncertainty.

“I see AI as an enabler – it will replace routine tasks, freeing finance professionals to spend more time on analysis and strategic planning.”

This or That? CFOs Quick-Fires

Reporting or forecasting?

Forecasting

Automation or personal interaction?

Automation, but human interaction remains essential

Excel or dashboard tools?

Dashboard tools, definitely

Historical analysis or scenario modeling?

Scenario modeling – it’s critical for proactive management

Driving sustainable change

Pirjo finds her current role at Oulun Energia particularly rewarding, given its active involvement in sustainability and the green transition. The company is heavily involved in significant capital-intensive projects, including green hydrogen initiatives and circular economy projects.

“These projects are exciting but complex. They require careful financial planning, significant capital investments, and close collaboration with various stakeholders.”

Pirjo sees finance playing a critical strategic role, supporting business decisions in managing these complexities:

“The uncertainty and fast-changing conditions mean scenarios can quickly become outdated. Automation and AI-driven forecasting tools help us adapt more efficiently.”

Advice for future financial leaders

Pirjo’s advice to aspiring financial leaders underscores the importance of continuous learning and adaptability.

“Stay curious, embrace new opportunities, and learn as much as you can about different industries,” she encourages. “Today’s CFO must constantly balance careful attention to detail with a strategic, forward-looking mindset.”

Looking back on her own journey, she offers a final insight that captures both the challenge and opportunity of modern financial leadership:

“The CFO role is constantly changing. To succeed, you need to be ready to adapt, learn, and help your organization respond effectively to new challenges.”

Pirjo Kivari

Born: 1972

Current position: CFO of Oulun Energia

Education: MSc (Economics), Authorized Public Accountant, Qualified Board Member

CFO Experience: 17+ years

Oulun Energia was founded in 1889 and their operations are based on energy production and heat and electricity network services. Oulun Energia employs about 250 energy professionals and promotes itself as Finland’s most energetic workplace. They are making the circular economy a significant pillar for their business. oulunenergia.fi

Oulun Energia partnered with Ropo in 2021 and upgraded to Ropo’s comprehensive invoice lifecycle service, Ropo One™ Embed, in 2024.

This article is part of Ropo’s CFO Insights and Trends series, featuring expert perspectives, key trends, inspiring financial leaders, and more.

Subscribe to CFO Insights and Trends

Stay ahead in financial leadership

Subscribe for CFO insights, featuring Inside the CFO Office interviews with inspiring financial leaders and influencers that spotlight their insights on leadership, financial management, emerging trends, and future outlooks.

The CFO Insights and Trends newsletter is delivered straight to your inbox approximately six times a year, and you can easily unsubscribe at any time.

Read more

Services & features

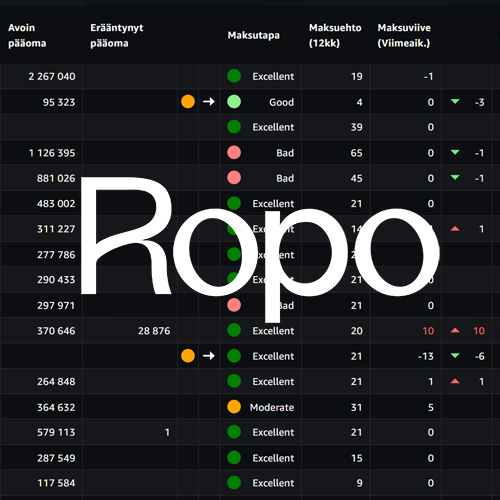

Ropo One™ Reporting – Financial Reports for Daily Operations

Read more

Client stories

Helsinki Region Environmental Services (HSY) Expands Partnership with Ropo

Read more

Services & features

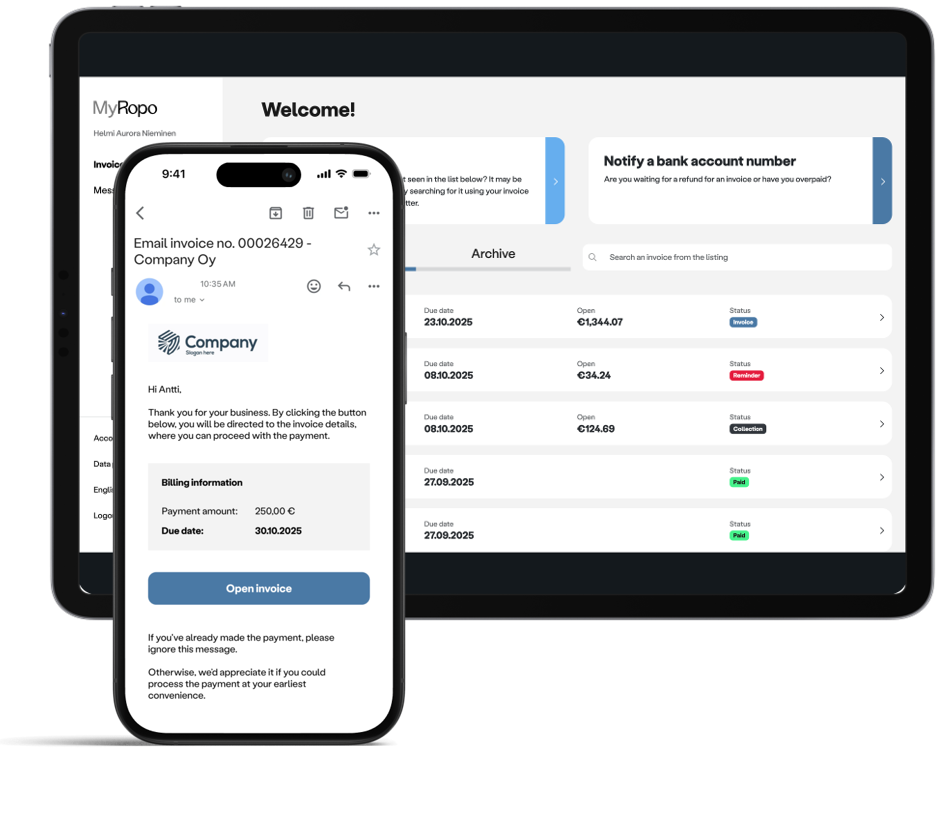

MyRopo Invoice – For A Frictionless Payment Experience

Read more

Services & features

Login: Finland

Login: Finland