Finland is proceeding with a change to its reduced VAT rate, lowering it from 14% to 13.5% effective January 1, 2026. The legislative proposal is in the final stages of parliamentary approval and is expected to enter into force as planned.

The reduced VAT rate applies to several key categories, including food products, restaurant and catering services, accommodation, passenger transport, cultural and sports services, and pharmaceuticals.

This adjustment affects companies operating in these sectors, which may need to update pricing structures and ensure that their invoicing and financial systems support the new rate.

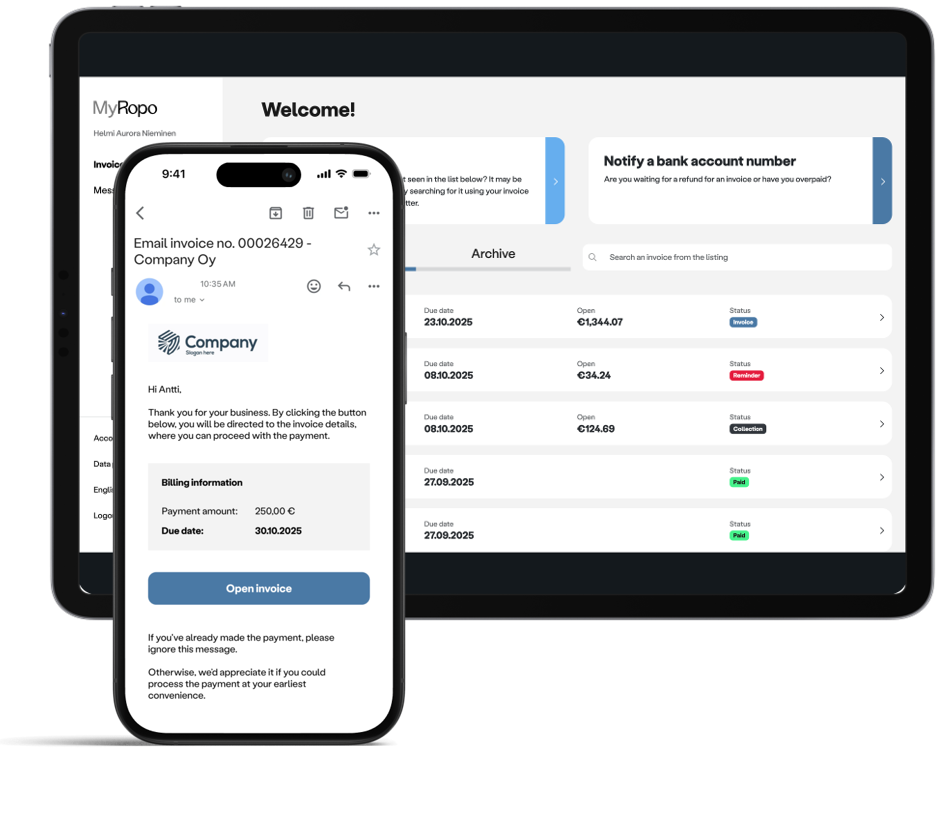

At Ropo, we have prepared for the transition, and Ropo One™ already supports the new 13.5% reduced VAT rate to ensure a smooth changeover for clients operating in affected industries.

VAT rate changes serve as a reminder of the importance of adaptable financial and invoicing systems. Companies with automated workflows, clear tax configurations, and well-coordinated processes are better positioned to handle regulatory adjustments while maintaining accuracy and compliance.

For detailed information on Finland’s VAT categories and the determination of tax rates, please refer to the Finnish Tax Administration.

Read more

Services & features

MyRopo Invoice – For A Frictionless Payment Experience

Read more

Services & features

Ropo One™ Product Updates – February 2026

Read more

Insights & Trends

Inside the CFO Office: Herkko Soininen, Mehiläinen

Read more

Life at Ropo

Login: Finland

Login: Finland