Invoicing processes are the financial backbone of any business, yet many companies still rely on manual, fragmented workflows that create inefficiencies, increase costs, and slow down cash flow. As businesses scale and seek competitive advantages, the question isn’t whether to automate invoicing processes – it’s understanding which parts deliver the most value.

At Ropo, we’ve implemented automation solutions across thousands of invoicing projects, helping Nordic companies transform their financial operations completely. To understand which automation opportunities deliver the most value, we spoke with Jyri Leinonen, Head of Implementations at Ropo Group, who leads the team responsible for these transformations and brings extensive experience from successful automation implementations.

“Our core mission is simple,” explains Leinonen. “We handle the complex automation definitions, so our clients don’t have to. From day one, we build the processes that ensure automation delivers measurable results.”

With deep expertise in converting invoicing and accounts receivable processes onto the Ropo One™ platform, the Implementations team ensures automation levels rise systematically while key metrics like DSO, automation rates, and timely reminders start improving from the first day of production. Through this extensive experience, we’ve identified the critical automation opportunities that beat financial friction and deliver measurable results for smoother business flows.

Jyri Leinonen

Head of Implementations, Ropo Group

Getting started: Automated data validation sets the foundation

The most critical starting point for any invoicing automation initiative is data validation and processing. When invoice data enters the system, it must be validated to ensure it contains all the necessary information for downstream processes.

“We never want to manually process our clients’ invoice data,” emphasizes Leinonen. “We have automatic processing that handles invoice data and ensures it’s valid for the service provided for the client – that it contains sufficient information for what comes next.”

Getting this foundation right prevents a cascade of manual work later in the process. If incomplete or faulty data enters the invoice flow, it creates significant challenges and manual interventions throughout the entire process. Ensuring robust data validation at the beginning eliminates these downstream complications and establishes the foundation for seamless automation across all subsequent steps, and ensures consistent customer experiences from day one.

Core automation opportunities that drive immediate impact

Where should you focus your automation efforts for maximum impact? Start with these four areas that transform invoicing operations from reactive to proactive.

Invoice generation and delivery. Automated invoice creation and distribution eliminate manual data entry errors while ensuring invoices reach the right recipients through their preferred channels. “Our Ropo One™ system routes invoices through multiple channels across dozens of countries, adapting to local preferences and requirements automatically,” explains Leinonen.

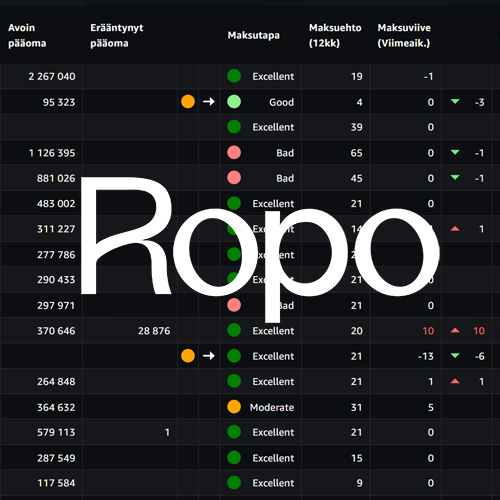

Payment monitoring and reconciliation. Automated payment tracking and reconciliation dramatically reduce manual effort in financial reporting. Instead of spending weeks at month-end reconciling accounts, automated systems provide real-time visibility into payment status and automatically update sales ledger records. “It’s a significant advantage that finance teams can expect overnight updates on previous day’s transactions, enabling faster month-end close processes,” notes Leinonen.

Reminder and collection processes. Systematic automation of payment reminders and collection activities ensures reliable, timely follow-up without manual intervention. “Customized late payment flows are an effective way to support cash conversion while ensuring high-quality end customer experience,” adds Leinonen.

Real-time reporting and analytics. Automated reporting provides immediate visibility into key performance indicators, enabling finance teams to make informed decisions. “Seamless processes with built-in reporting and data access are key factors for successful companies. Data-driven decision-making is crucial,” emphasizes Leinonen.

The deeper value: Standardization without rigidity

Beyond operational efficiency, automation delivers something equally valuable: standardized, predictable processes that create reliable experiences for both internal teams and end customers.

“When processes are automated, they work consistently every time – there’s no variability in quality or arbitrary decision-making,” explains Leinonen.

“This creates predictable, high-quality experiences for both our clients and their customers. Consistent automated processes ensure end customers receive reliable service throughout the entire invoicing and payment journey.”

The Implementations team builds this consistency through systematic project frameworks spanning an average of 3-5 months – from kick-off and data validation through technical implementation, testing, and go-live. “We establish automation rules for payment matching, credit management, reminder sequences, and reporting from day one,” notes Leinonen. “The goal is high touchless processing rates immediately when we go live.”

Standardization transforms operations by enabling more effective resource planning, delivering dependable customer experiences throughout the invoice lifecycle, and providing real-time data flows that improve financial control and strategic decision-making.

Yet standardization doesn’t mean losing flexibility. Advanced automation systems enable tailored approaches for different business relationships, ensuring high-value partnerships receive appropriate attention while maintaining efficient processes across your entire customer base. “Segmentation can be done so that important clients receive different treatment than one-time buyers,” explains Leinonen. “For example, when a high-value customer misses a payment deadline, we can alert account managers rather than automatically triggering collection processes.”

Industry-specific expertise makes the difference

Flexibility extends beyond individual customer relationships to entire industry sectors. Different industries require tailored automation approaches that respect sector-specific regulations and practices.

“Typically, every industry has its own established and regulated ways of operating payment control actions,” notes Leinonen. “We make sure to follow best practices and ensure that the process aligns with good debt collection standards, so our clients can maintain positive customer relationships while achieving effective results.”

Energy companies, for instance, expect disconnection processes to be included in their payment control activities for ongoing utility services, while treating one-time service charges differently. Media corporations, on the other hand, require suspending subscriptions if invoices are not paid. Such industry expertise becomes a competitive advantage – understanding how to adapt automation to industry standards and best practices while leveraging Ropo’s deep knowledge of what works most effectively across different sectors.

Implementation best practices: Look forward, not backward

One of the most significant factors determining automation project success is the mindset organizations bring to the transformation. Companies that focus on replicating existing processes often miss opportunities to achieve step-change improvements in efficiency and effectiveness.

“The typical mistake companies make is trying to automate their current process exactly as it is,” notes Leinonen. “Instead, ask: how could we do this better? Companies that only want precisely what they had before often miss the biggest opportunities for improvement.”

This forward-thinking approach is embedded in Ropo’s collaborative implementation methodology. “When we’re undertaking such a large process transformation, we work closely with our clients to understand their unique processes and goals. We don’t focus on how things were done before – we focus on how they could be done better in the future,” explains Leinonen. “By partnering with our clients throughout the project, we can design flows that work perfectly from their specific business objectives.”

The most successful automation projects start with understanding desired outcomes rather than copying existing workflows. This approach enables organizations to leverage automation’s full potential rather than simply digitizing inefficient manual processes.

Building for scalable growth

While improving current operations, quality and efficiency are the typical drivers of modern invoicing automation initiatives. However, resource optimization delivers equally important benefits.

With thoughtfully implemented automation, financial administration teams can manage growing invoicing volumes without expanding headcount. This allows teams to focus on high-value tasks rather than repetitive manual routines – empowering businesses to expand without constantly adding back-office resources.

“Resource planning becomes much easier when you have repeatable, standardized automated processes,” observes Leinonen. The systematic approach ensures scalability becomes particularly valuable as businesses grow across markets or customer segments.

Well-designed automation systems are built to adapt. They accommodate new requirements and jurisdictions without the need for large-scale IT projects, all while maintaining operational consistency.

For organizations ready to transform their invoicing operations, the opportunity extends far beyond cost savings. Automated invoicing processes enable better liquidity management, improved customer experiences, and the operational resilience needed to thrive as markets evolve.

The question isn’t whether invoicing automation delivers value – it’s whether your organization is ready to capture that value and build for a better-flowing future.

Ready to transform your invoicing operations?

Ropo One™ provides end-to-end automation for your entire invoicing lifecycle – from invoice creation and delivery to payment monitoring and collection processes. Our comprehensive platform delivers the automation benefits discussed in this article: improved cash flow, reduced manual work, standardized processes, and full visibility across your invoicing operations.

Our expert implementation team works with you to determine the best solution for your specific needs and industry requirements. Thousands of Nordic companies already trust Ropo to handle their invoicing automation.

Contact us to learn how Ropo One™ can beat financial friction and create smoother business flows for your organization.

Read more

Life at Ropo

Employee Spotlight: Oona Koponen, Payment Transaction Specialist & Team Lead

Read more

Services & features

Ropo OneView™ – Real-Time Visibility for Smarter Financial Decisions

Read more

Reports & Research

Smooth Implementation: How Ropo Clients Navigate Major System Changes

Read more

News

Login: Finland

Login: Finland