This article is based on the original interview with Trung Minh Tran, Country Manager of Ropo Norway, published in Økonomi24, written by Einar Ravndal.

When Trung Minh Tran, Country Manager of Ropo Norway, talks about invoicing, his perspective is far from traditional. For him, it’s not about reminders or collection letters – it’s about data flow, automation, liquidity, and predictability.

As featured in Norwegian business newspaper Økonomi24, Trung explains how Norwegian companies are rethinking the entire invoice lifecycle, and why modernizing this flow has become a strategic priority for finance leaders across the country.

A modern approach to the invoice lifecycle in Norway

Ropo entered the Norwegian market by acquiring three previously separate companies within invoice delivery and receivables management: BAHS Kapital AS, Posti Messaging AS, and Demand Norge AS. Each of these organizations had long focused on a small segment of the invoice-to-cash process, operating with more traditional setup and fragmented workflows.

By merging them into Ropo Group, the Norwegian operations became part of Ropo’s holistic, technology-driven model – connecting previously separate parts of the invoice lifecycle into a seamless, end-to-end flow that covers invoice delivery, sales ledger management, payment monitoring, and collection activities.

Trung describes that early phase candidly:

“Many people think invoicing and payments are simple, but they’re actually quite complex. When something goes wrong, it quickly becomes fragmented and difficult to follow up. Even if individual systems work well, the problems appear when they don’t communicate with each other.”

This is where Ropo’s proprietary, technology-led approach has played a significant role.

By providing one connected, automated flow through Ropo One™, companies can finally treat invoicing as one uninterrupted lifecycle – from sales ledger management, reconciliation, and real-time oversight.

Automation that improves cash flow and reduces manual work

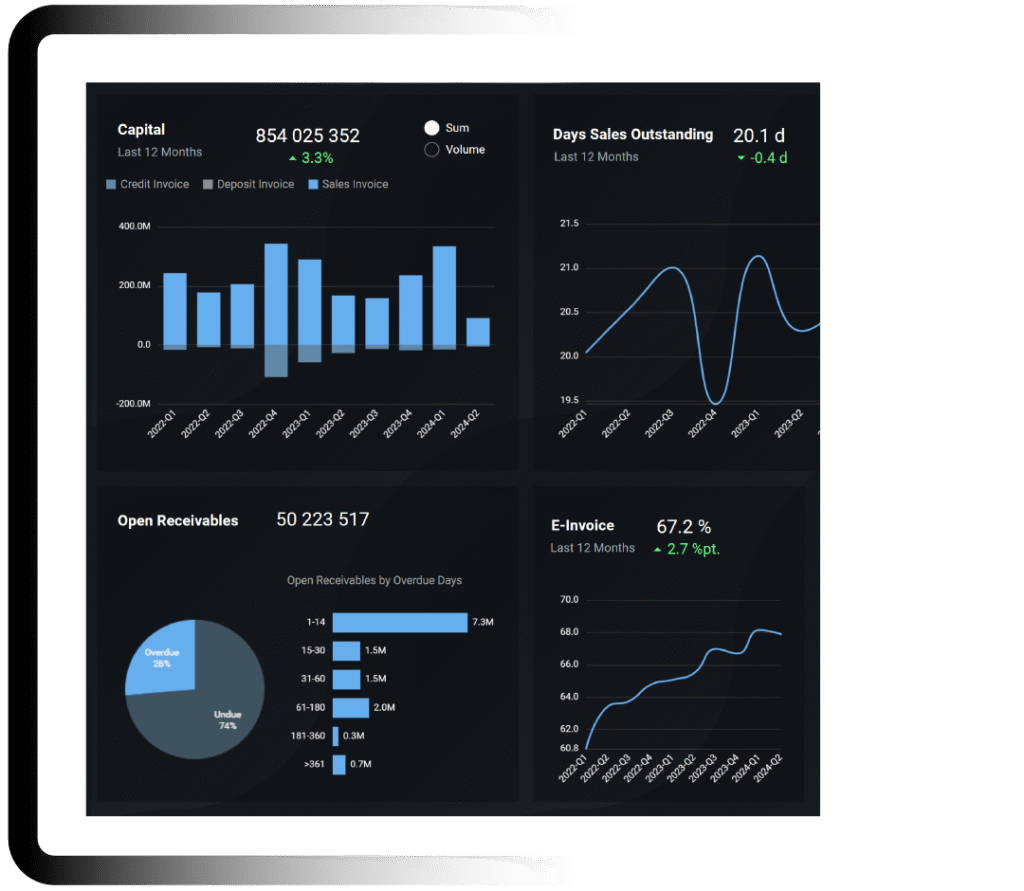

Norwegian companies adopting Ropo One™ have seen measurable impact. With automated processes and one connected workflow supporting the full invoice lifecycle, finance teams gain time, transparency, and control.

“Our technology handles everything from invoicing to incoming payments and reconciliation in one system,” Trung says. “That means less manual work, fewer errors, and faster cash flow.”

Companies typically reduce manual workload in their finance departments by 30–100%, while improving Days Sales Outstanding (DSO) by around three days. For organisations with significant invoice volumes, even a small improvement in DSO can have a substantial effect on liquidity.

“Three days may sound small, but for companies with large receivables volumes, that improvement has an enormous impact on liquidity,” Trung notes.

For finance leaders, the benefits extend beyond efficiency. When automation brings accuracy, predictability, and visibility into finance processes, the workday becomes significantly calmer:

“CFOs and finance managers sleep better when they know everything runs as it should,” he says. “When invoices are sent correctly, payments arrive as expected, and insight is available instantly, it gives real peace of mind.”

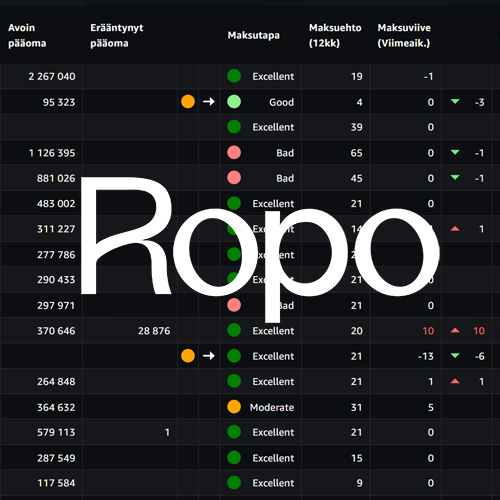

Predictive insight with Ropo OneView™

Trung highlights Ropo OneView™ – Ropo’s real-time business intelligence tool – as one of the most transformative elements for finance teams. Instead of relying solely on retrospective reporting, companies gain forward-looking visibility into how payment behaviour affects liquidity.

“With Ropo OneView™, you can see who pays late, who always pays on time, and what happens if payment delays increase from five to ten percent,” he explains. “It’s about predicting what will happen – and acting before it happens.”

This proactive approach gives companies the ability to make decisions earlier, manage risk more effectively, and maintain stronger liquidity – well before challenges start to surface.

Norway leads the Nordics in invoice digitalization

Norway’s rapid adoption of digital invoice processes has created a strong foundation for Ropo’s technology-led approach. Among Ropo’s Norwegian customers, 93% of invoices were digital last year, rising to 95% in 2025, by far the highest share in the Nordics.

Finland and Sweden are following the same trend, but at a slower pace, with digital shares of 72% and 82% respectively.

Trung sees Norway’s position clearly:

“Norwegian businesses are among the best in the world on digitalisation. Efficient, digital invoice flows are more cost-effective, more environmentally friendly, and definitely faster. Norway is leading the Nordics in this shift toward fully digital invoicing.”

For companies using Ropo’s solutions, digitalisation also translates into measurable improvements in payment times and reduced delays – strengthening liquidity and improving predictability.

Strong growth – and even stronger ambitions

Ropo now processes 144.6 million invoices annually across the Nordics for more than 11,000 clients, including major Norwegian companies such as DB Schenker, Strawberry, Norsk Gjenvinning, PELIAS, Skandia Greenpower, and Bodø Energi.

In Norway alone, around 50 specialists support clients from Bergen, Sandefjord, and Oslo, working daily with companies to optimise invoice and payment processes, identify improvement opportunities, and ensure a seamless flow.

Growth has been particularly strong in both Norway and Sweden, and the ambitions continue to rise.

“Our goal is that by 2030 we will handle 26 million invoices annually in Norway,” Trung says. “The scalability is there, and so is the technology to support it.”

A seamless flow for a more resilient financial future

Ropo’s vision in Norway is clear: to make invoicing more seamless, predictable, and value-creating for companies – especially those with high and recurring invoice volumes. By connecting automation, insight, and modern digital processes, Ropo is helping businesses reduce friction, improve liquidity, strengthen decision-making, and build a better-flowing financial future.

Trung summarises it simply:

“When the invoice flow works smoothly, the whole business flows better.”

Read the full original interview by Einar Ravndal on Økonomi24 (in Norwegian).

Explore our service

Unify your invoicing process to improve control, visibility, and customer experience. Ropo helps you streamline your invoice and payment flows end-to-end for efficiency and optimized cash flow.

Read more

Services & features

Ropo One™ Reporting – Financial Reports for Daily Operations

Read more

Client stories

Helsinki Region Environmental Services (HSY) Expands Partnership with Ropo

Read more

Services & features

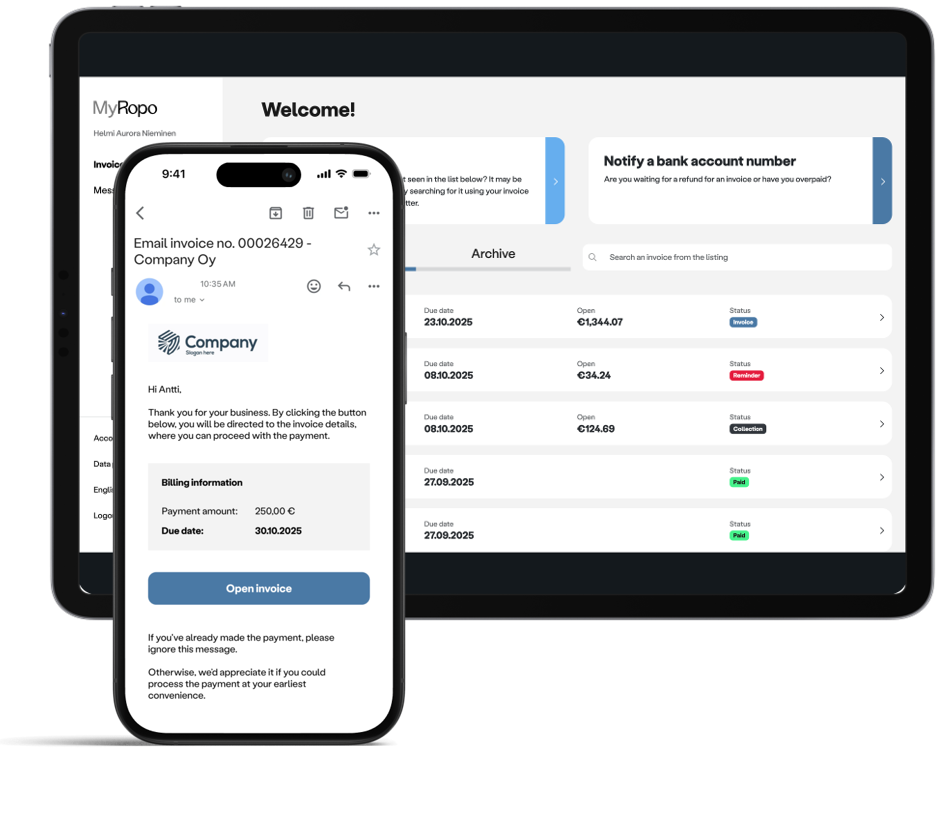

MyRopo Invoice – For A Frictionless Payment Experience

Read more

Services & features

Login: Finland

Login: Finland