In our series Inside the CFO Office, we meet financial leaders who share their perspectives on leadership, strategy, and the changing role of finance. This time, we meet Satu Järvinen, CFO of Hartwall, a long-standing Ropo client since 2014. Satu brings a clear, human perspective to the profession, but her path to the role was not one of rigid planning. Instead, it has been shaped by curiosity, a wide range of opportunities, and a willingness to say yes before having all the answers.

Satu studied at the Helsinki School of Economics and has worked her entire career in finance roles, though she encourages others not to feel bound to one linear path. “There isn’t just one route to becoming a CFO,” she says. “Some of my team members have stepped into sales or marketing roles and then returned. Those experiences only strengthen their insight and strategic thinking.”

Before joining Hartwall, Satu held several leadership roles in finance across different industries. She joined the company in 2017 and has led the finance function through both uncertainty and transformation since 2018. Hartwall, while part of the Danish Royal Unibrew Group, operates with significant local autonomy. For Satu, that means having both the responsibility and the opportunity to shape the company’s financial direction directly from Finland.

Finance as a common language and strategic foundation

She leads a team of finance professionals whose scope covers everything from traditional accounting to strategic financial planning. The work is fast-paced, and the expectations – both internal and external – are high. “There’s the core responsibility: getting the numbers right, having reliable data. But increasingly, our role is to translate that data into insight and support smart, timely decisions across the business.”

This ability to connect the numbers to the broader business context is central to how Satu views the role – and finance itself.

“I’ve always been interested in finance, but more from the perspective that numbers and financial language are a clear form of communication. I see finance as something that helps make things transparent and understandable. In the end, it connects to everything – whether we’re talking about managing personal finances or achieving a company’s long-term goals. It’s a versatile language that opens professional doors and helps people pursue their dreams.”

“I often say that finance isn’t just for ‘finance people’ – it’s the language of business. It allows you to truly understand how things work and make informed decisions. That’s always been the part I’ve found most meaningful.”

Satu Järvinen, CFO at Hartwall

Shifting from reporting to enabling better decisions

A central part of Satu’s leadership philosophy is clarity. “Leadership isn’t about micromanagement,” she says. “It’s about helping people understand what good looks like – and why it matters. If we don’t define that clearly, teams can work really hard but still pull in different directions.”

One of her strengths, she adds, is helping to put things in context: “Sometimes different functions seem at odds – sales pushing one way, marketing another, finance a third. But often it’s just a lack of shared understanding. I see part of my job as showing how the pieces connect so that people can move forward with confidence.”

In her day-to-day work, Satu is closely involved in translating strategic objectives into financial reality. Hartwall’s performance is tracked through a number of metrics, but two in particular rise to the top: EBITDA and cash flow. These two indicators, she explains, reflect both how well the company is operating and how independently it can move in uncertain times.

“Profitability and strong cash flow enable us to make decisions locally, without waiting for direction from elsewhere. They give us room to act.”

From financial accuracy to strategic foresight

As the finance function becomes more reliant on data, Satu sees the need not just for new tools, but for new ways of thinking. The challenge is no longer about having data, but about choosing the right data, and using it in the right way.

“There’s more data than ever – but we can’t use it all. The real value is in interpretation, in deciding what’s actually relevant. And then in helping others use it, not just collecting it.”

Automation and artificial intelligence are a part of that shift, and Satu is optimistic about their potential: not to replace humans, but to elevate the work people do.

“If we can automate routine tasks, then people have more time for work that really adds value – solving problems, anticipating risks, thinking about the future.”

Scenario planning has become a critical part of the CFO’s toolbox. Budgets are still useful, Satu says, but they become outdated quickly. Instead, flexible forecasting and the ability to model multiple scenarios are now essential. “We might spend months building a budget,” she says, “but by the time it’s approved, the world has already changed. It’s the direction that matters – but we have to be ready to adjust the path at any time.”

Risk management today involves more complexity than ever. Alongside familiar macroeconomic and supply chain risks, today’s CFOs are also navigating cybersecurity threats and AI-related questions of data reliability. “Our internal controls have to evolve just as fast as the technology does,” Satu explains. “And when we rely on systems that use AI, we have to be sure the data they’re built on is solid. We can’t afford to base decisions on flawed assumptions.”

Learning across roles – and earning trust through clarity

When asked what advice she would offer aspiring CFOs, Satu returns to the idea of openness – to learning, to different perspectives, and to stepping outside your comfort zone.

“Try new things. Don’t just climb the ladder – take side steps, explore. There’s huge value in seeing the business from many angles. You’ll be a better partner to the rest of the organization if you’ve stood in someone else’s shoes.”

She adds one more, essential piece of advice:

“And know your numbers. That’s the foundation. If you don’t really know your numbers, it’s hard to build trust – hard to lead.”

Satu Järvinen

Born: 1981

Current position: CFO at Hartwall Oy

Education: MSc / Economist from Helsinki School of Economics

Career: In financial management positions since 2012

Hartwall’s mission is to refresh Finland. Company’s wide portfolio ranges from water to wines and spirits. It includes iconic soft drinks such as Hartwall Jaffa, the world’s first RTD drink Hartwall Original Long Drink and leading water brand Hartwall Novelle. Hartwall is also the partner of Heineken and Pepsi brands in Finland, and it imports hundreds of quality beverages from around the world, from wines to coffee.

As a part of Royal Unibrew, Hartwall aims to produce the most sustainable drinks in the world. Hartwall’s production facilities in Lahti and Turku are already carbon neutral, and its goal is to cut CO2 emissions in half by 2030 – throughout entire value chain. Hartwall also promotes a responsible drinking culture and brings new low and non-alcoholic products to its range. Hartwall has over 700 employees. en.hartwall.fi/

Hartwall has been a valued Ropo client since 2014.

Subscribe to CFO Insights and Trends

Stay ahead in financial leadership

Subscribe for CFO insights, featuring Inside the CFO Office interviews with inspiring financial leaders and influencers that spotlight their insights on leadership, financial management, emerging trends, and future outlooks.

The CFO Insights and Trends newsletter is delivered straight to your inbox approximately six times a year, and you can easily unsubscribe at any time.

Read more

Services & features

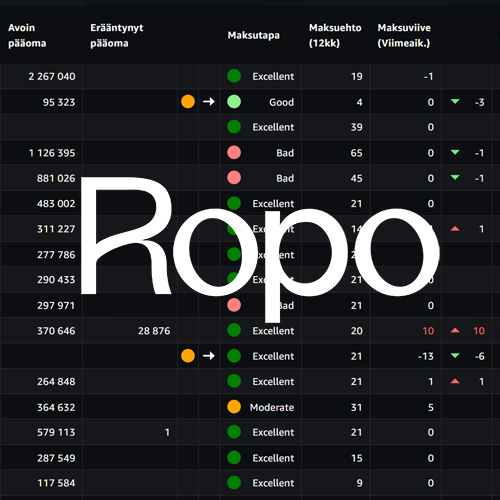

Ropo One™ Reporting – Financial Reports for Daily Operations

Read more

Client stories

Helsinki Region Environmental Services (HSY) Expands Partnership with Ropo

Read more

Services & features

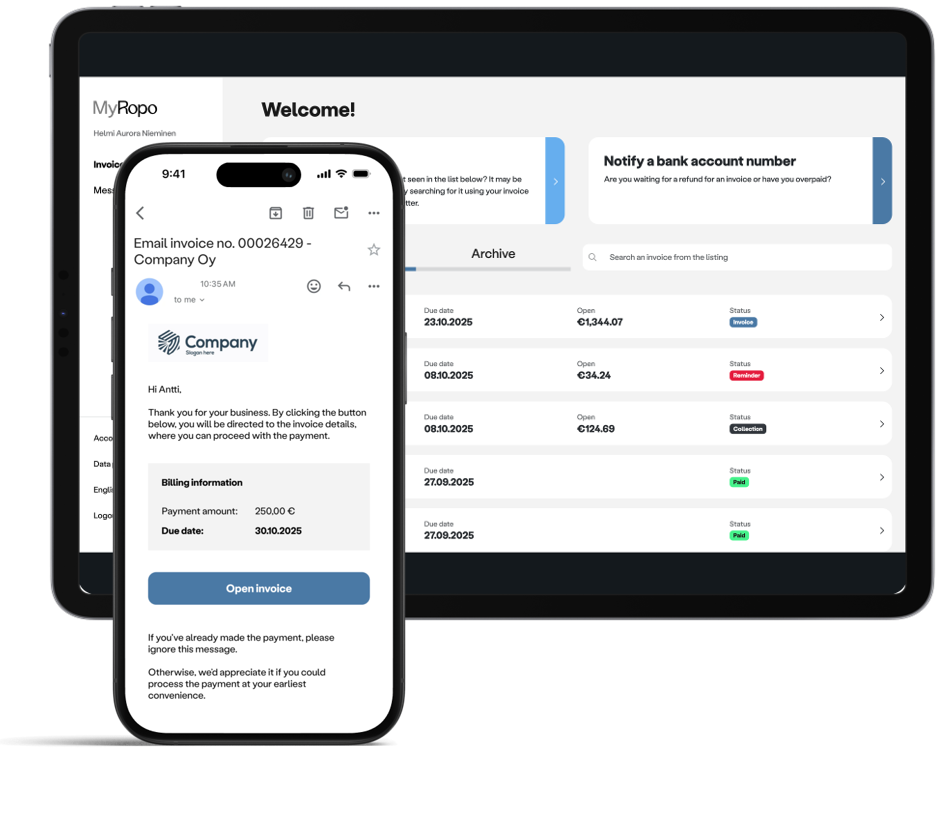

MyRopo Invoice – For A Frictionless Payment Experience

Read more

Services & features

Login: Finland

Login: Finland